Ever wish your budget reports came with a search bar? You’re not alone. Finance teams everywhere are spending more time wrestling with spreadsheets than uncovering real insights. The pressure to deliver faster, smarter decisions is higher than ever, but legacy tools? They’re more of a roadblock than a runway. Between manual workflows, scattered spreadsheets, and siloed systems, it’s no wonder bottlenecks keep popping up like unwelcome pop quizzes.

But here’s the good news: AWS has a solution up its sleeve. By leveraging Generative BI within Amazon Q in QuickSight, you get a conversational co-pilot for financial reporting and analysis. This smart duo doesn’t just crunch the numbers, it helps you understand them, minus the spreadsheet gymnastics.

In this blog, we’ll dive into how Generative Business Intelligence (BI) is transforming the way finance teams operate, uncovering the solution and the game-changing benefits it brings to the table.

The Problem with Traditional BI in Finance

Let’s address the real elephant in the room, the problem with traditional BI in finance. Most legacy BI tools were built for another era, back when getting insights meant submitting a request, waiting days for a report, and hoping it still mattered by the time it arrived. These tools are technical, clunky, and far from user-friendly. For finance teams striving to stay agile, that kind of delay is a major roadblock.

Here are the core challenges:

- Data Silos: Financial data is often fragmented across ERP systems, spreadsheets, and departments, making it difficult to get a unified view.

- Manual Effort: Generating reports requires heavy IT involvement and manual data wrangling, delaying insights and reducing agility.

- Lagging Insights: Traditional BI is reactive, not predictive. It tells you what happened, not what will happen.

- Limited Self-Service: Finance teams depend on analysts or IT for report customization, limiting real-time decision-making.

- Poor Scalability: As data volumes grow, legacy BI systems lack the performance and flexibility to handle complex, real-time analytics.

The result? Long waits for real-time, actionable insights. Static reports become outdated the moment they’re generated, and decision-making starts to feel more like guesswork than strategy. In a fast-moving financial landscape, these delays can cost you a lot.

The Power of Generative BI with Amazon Q in QuickSight for Financial Analysis

To move past these challenges, finance teams need more than just fast reporting. They need a smarter and easier way to work with data. That’s where Generative BI with Amazon Q in QuickSight steps in. Powered by Amazon Q and integrated with Amazon Bedrock’s large language models (LLMs), QuickSight allows users to ask questions, analyze trends, and build dashboards using simple, plain English.

And, what do you get? Actionable, accessible, and easily understandable insights, exactly when finance teams need them most. It automates repetitive tasks, speeds up insights, and boosts productivity. Finance teams can finally shift focus from manual work to strategic analysis.

Are you curious to learn how Generative BI is transforming analytics? Explore our blog to dive deeper into the powerful capabilities of Amazon Q in QuickSight.

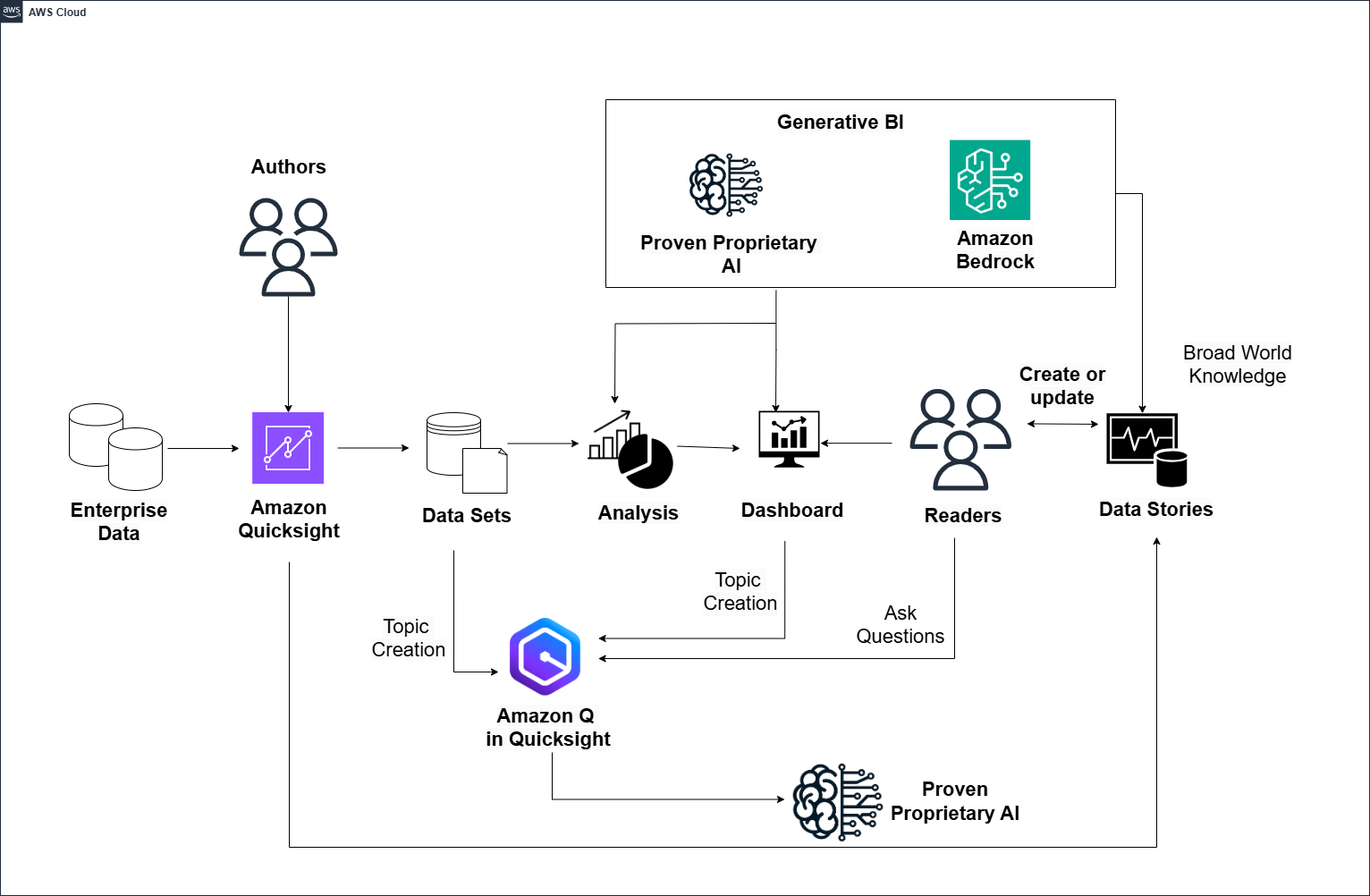

Figure 1: The Architecture and Workflow of Generative BI With Amazon Q in QuickSight

This diagram illustrates the workflow of Generative Business Intelligence (BI) with Amazon Q in Amazon QuickSight. It outlines how data is transformed into insights and how users can interact with it using natural language powered by AI. Here are the steps of the workflow:

- Ingest Enterprise Data: Enterprise data from various sources is brought into Amazon QuickSight, initiating the data journey.

- Prepare and Manage Data: Authors (BI developers/analysts) use QuickSight to clean, transform, and manage data for analysis.

- Create Topics with Amazon Q: Authors leverage Amazon Q in QuickSight to create topics and semantic layers that structure datasets for natural language querying.

- Generate Analyses and Dashboards: Prepared datasets are used to build analyses and dashboards in QuickSight, enabling visual interpretation of insights.

- Ask Questions Using Natural Language: Readers (end-users) ask questions in natural language. Amazon Q interprets these using AI to generate relevant visual or textual responses.

- Create Data Stories: Insights from dashboards or queries are compiled into data stories combining visuals and explanations for easier sharing and understanding.

- Leverage Proprietary AI Models: Amazon Q then uses pre-trained, proprietary AI models to accurately generate topics, understand user queries, and deliver context-aware answers.

- Enhance with Amazon Bedrock Integration: Amazon Bedrock brings in foundation models (FMs) and world knowledge to boost generative capabilities, supporting advanced reasoning, storytelling, and Q&A.

Generative BI in Action: Real-World Use Cases for Financial Teams

Dealing with massive amounts of data can quickly become overwhelming. Generative BI helps cut through the noise by turning complex data into clear, actionable insights. In this section, we’ll look at how real financial teams are using it to simplify reporting, uncover trends, and drive better decisions.

1. Cash Flow Analysis Made Conversational

Cash flow analysis is the lifeblood of financial strategy. It is traditionally a data-heavy and technical process. However, it can become far more accessible and intuitive with the help of Generative BI. By leveraging AI and natural language processing, Business Intelligence tools such as Amazon Q in Quickight transform complex financial datasets into clear, conversational insights that are easy to interpret and act on.

Instead of digging through spreadsheets or building complex reports, users can simply ask questions in plain English. For example:

“Show me cash flow from operating activities for the last quarter,” or “What are the key drivers behind the decrease in cash flow?”

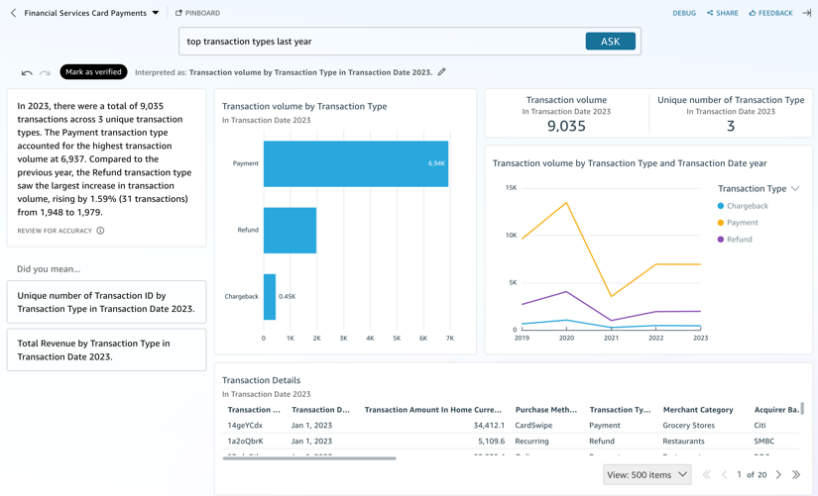

Generative BI interprets the intent and returns precise, visual, and actionable answers. The figure below illustrates how a typical natural language interaction within Amazon Q in Quicksight reveals insights about cash flow in a clear and user-friendly format.

Figure 2: AI-Powered Cash Flow Insights via Natural Language Query (source)

If you’re looking to gain deeper visibility into your AWS cloud spend, our latest blog on The AI Assistant for Understanding Your AWS Costs: Amazon Q in QuickSight provides an in-depth look at how Amazon Q is transforming cost analysis.

2. Variance Analysis at Speed

Imagine a marketing team at a growing e-commerce company that needs to quickly assess their monthly budget performance. Traditionally, they would have spent hours pulling data from spreadsheets, slicing it into different categories, and manually calculating variances. With Amazon Q in QuickSight, they can skip the manual process and instantly identify discrepancies.

The scenarios feature in Amazon Q in QuickSight helps users perform complex analyses such as variance analysis much faster than spreadsheets. In a few clicks, they explore what-if scenarios, adjusting budget assumptions and immediately seeing how potential changes will affect overall spending. For example, if a campaign is over-performing and they want to reallocate funds from another budget area, they can instantly compare these adjustments to historical data, seeing both the immediate impact and potential long-term results. Moreover, Generative BI allows previous analyses to be modified and reused, making it easier to adapt to changing business needs.

If you are interest in learning about Scenario Analysis in Amazon Q in Quicksight, dive into our blog, How Scenario Analysis in Amazon Q in QuickSight Transforms Decision-Making

3. Real-Time Budget Monitoring

Amazon Q in QuickSight enhances financial data analysis by automating real-time dashboards. This enables proactive alerts and delivers forecast insights through natural language queries. With automated dashboards, finance teams can continuously track key metrics such as revenue, expenses, and cash flow without manual updates. This ensures decisions are always based on the most current data.

Intelligent alerts notify users of anomalies such as sudden drops in profit or unexpected cost spikes. These alerts help teams act quickly to address any potential risk and fraud. Forecasting capabilities allow users to generate accurate projections for budgeting and planning. By asking questions like “What are the projected operating expenses for Q3?”, analysts receive AI-generated insights powered by Amazon Bedrock models.

These features enable CFOs and finance teams to improve reporting efficiency, reduce manual workload, and make faster, data-driven decisions.

4. Financial KPI Monitoring and Executive Reporting

With Amazon Q in QuickSight, finance teams can elevate KPI monitoring and executive reporting by leveraging large language models (LLMs) to automatically generate executive summaries of dashboards. These summaries highlight key financial metrics, trends, and anomalies making it easier for executives to understand critical insights immediately. Through natural language Q&A, teams can ask questions like “What caused the spike in Q2 operational expenses?” and receive instant and accurate AI-generated responses.

Generative BI also enables granular financial analysis with resource-level and hourly data, going beyond the default 14-day history. Combined with custom visualizations and integration across data sources, it simplifies performance tracking, enhances data storytelling, and reduces the time spent preparing reports.

5. Risk Management and Fraud Prevention

Manual data handling often introduces errors that can lead to incorrect risk assessments. With Amazon Q in QuickSight, those risks are minimized. Automated data analysis reduces human error, ensuring more accurate and consistent insights. Instead of relying on static spreadsheets, teams can run dynamic scenarios to understand potential outcomes and respond quickly to emerging threats. This improves the reliability of risk analysis, helps prevent financial fraud, and supports faster, data-driven decisions in high-stakes situations.

Additionally, finance teams may leverage Generative BI capabilities to detect anomalies, predict market shifts, and assess financial exposure in real time. Flagging unusual transactions, patterns, or behaviors can play a critical role in fraud detection before it escalates.

Key Benefits of Using Amazon Q in QuickSight for Financial Analysis

Amazon Q in QuickSight makes financial analysis faster, clearer, and more accessible. It helps teams quickly get answers from complex data, build dynamic reports, and uncover insights with natural language, no advanced technical skills required. Here are some key benefits:

- Faster, More Accurate Insights: Generative BI drastically reduces the time spent preparing reports and analyzing data. Finance professionals can receive real-time answers to complex questions with improved accuracy, freeing them from manual data manipulation and allowing them to focus on strategy and decision-making.

- Data-driven Decision-Making: With live, accurate data at their fingertips, finance leaders can base their decisions on evidence rather than assumptions. Whether planning budgets, allocating capital, or adjusting for market shifts, teams have the confidence to act quickly and strategically.

- Centralized View of Financial Performance: QuickSight brings together key financial metrics—such as revenue, cost, cash flow, and investment performance—into a single, interactive dashboard. This unified view helps teams spot trends, identify issues, and understand the broader financial picture without switching between tools or reports.

- Automated, Audit-ready Reporting: Recurring financial reports can be scheduled and generated automatically, with built-in data integrity and formatting standards. This not only saves time but also ensures that reports are accurate, consistent, and aligned with audit and regulatory expectations.

- Smarter Forecasting and Scenario Planning: Generative BI allows users to explore “what-if” scenarios with ease. For example, modeling the financial impact of a drop in sales or a change in raw material costs. These insights help businesses prepare for uncertainty and adapt quickly to market changes.

- Cost Savings Through AWS Integration: Since QuickSight is built natively on AWS, there is no need for additional tools or third-party platforms. Finance teams benefit from secure, scalable performance at a lower total cost, with seamless access to other AWS data services.

Reimagine Financial Intelligence with Cloudelligent and Amazon Q in QuickSight

At Cloudelligent, we help finance teams unlock the full potential of their data with Amazon Q in QuickSight. With natural language queries, exploring data becomes effortless, our AI experts empower business users to dive into self-service analytics and speed up insights!

We help align business intelligence with your strategic goals by fostering a data-driven culture through real-time dashboards that enable quick, informed decisions. Leveraging AWS-powered business intelligence tools, our solutions enhance financial reporting and analytics while driving data literacy and team adoption.

Ready to explore how Amazon Q in QuickSight can elevate financial intelligence? Book a Free AI and ML Assessment with our experts, we’re here to guide you every step of the way!