Did you know that the global Generative AI in fintech market is projected to skyrocket from $1.18 billion in 2023 to an estimated $25.83 billion by 2033? That’s a staggering growth rate of 36.15% annually, signaling a seismic shift in the financial technology landscape. As industries worldwide adapt to the revolutionary power of Artificial Intelligence (AI), the fintech sector stands at the forefront of innovation.

In this blog, we’ll explore the intersection of challenges and opportunities AI brings to the fintech industry. From navigating regulatory hurdles to enhancing customer experiences, we’ll delve into real-world use cases that highlight the impact of Generative AI in fintech.

Curious about Generative AI? We’ve got the insights you need! Head over to our blog – 4 Questions About AWS Generative AI, Answered.

Navigating Challenges in the Fintech Industry

The fintech industry is poised to experience an explosive growth rate nearly three times its traditional banking counterparts from 2023 to 2028, as shared in a McKinsey Report. This rapid expansion brings a host of challenges. In this section, we’ll address some of the most pressing issues facing the fintech sector today.

1. Fraud Detection

The implications of undetected fraud are profound, extending beyond monetary losses. The fintech industry is challenged with key issues stemming from a variety of sophisticated fraud techniques. According to a report by Juniper Research, global online payment fraud losses are projected to exceed $20 billion by 2024. Phishing attacks, identity theft, account takeover (ATO), and payment fraud, are some of the prevalent threats in the fintech sector.

Ensure the highest level of protection for your fintech AI workloads with our specialized AWS Financial Services. Book a meeting with us today to discover how our cloud security solutions can automate risk mitigation, enhance threat detection, and maintain continuous compliance.

2. Risk Assessment

Proactively mitigating risks is crucial for fintech companies. Using tools that leverage Generative AI for fintech solutions can help analyze various data points. These include credit history, transaction patterns, and social media activity. Gen AI enhances accuracy in identifying high-risk applicants. Thus, reducing default rates, and improving loan performance.

3. Regulatory Compliance

Navigating regulatory compliance is a constant challenge for fintech companies. New regulations can disrupt current business models for some firms. This has led to increased costs and slower adoption. Conversely, the absence of regulations undermines customer trust.

4. Customer Support

Balancing innovation and top-notch customer support is crucial in fintech. Keeping teams lean, knowledgeable, and empowered is essential. Training teams to respond to crises is imperative. Leveraging robust systems and Gen AI, staff can adeptly handle disasters.

Leveraging the Transformative Power of Gen AI in Fintech

As we move into 2024, financial services have evolved beyond automation to be intelligent, intuitive, and innovative. Below, we explore Generative AI’s transformative capabilities through various use cases.

1. Data Extraction With Intelligent Document Processing

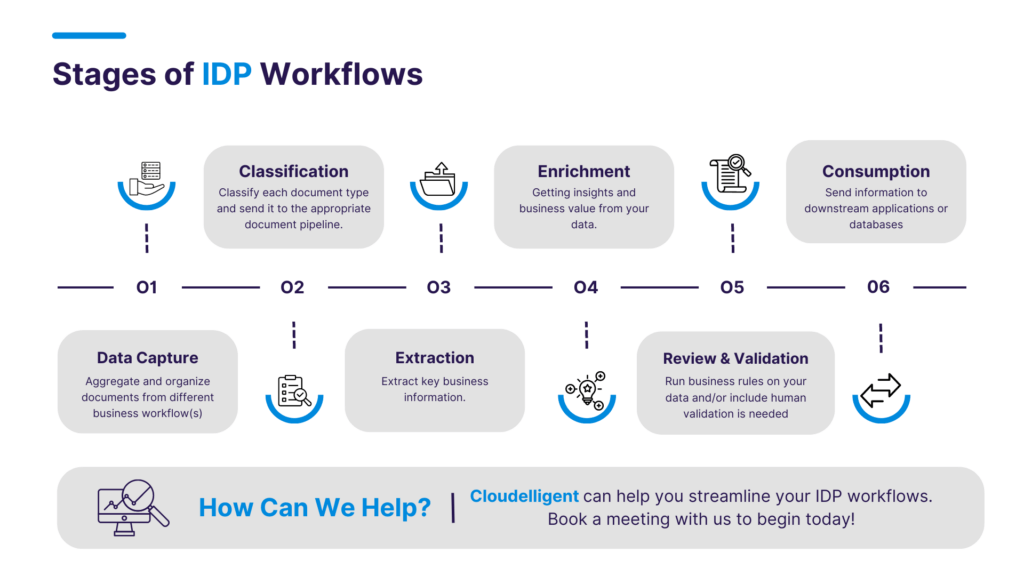

AI-powered Intelligent Document Processing (IDP) by cloud service providers like AWS quickly extracts information from various document types. It facilitates timely decisions and cuts operational costs. Automating IDP lets you focus on critical decisions while smart technology handles repetitive tasks. IDP workflows may vary, but typical stages are illustrated below.

Figure 1: Stages of Intelligent Document Processing Workflows

Let’s have a look at some major applications of IDP in the fintech industry:

- Streamlines expense report generation.

- Automates invoice processing.

- Manages employee and contractor payments.

- Extract figures from financial documents for efficient processing of future payments.

Discover how Cloudelligent helped a financial services firm enhance app performance and infrastructure management in this case study.

2. The Evolution of Banking AI Chatbots

Banking AI chatbots are reshaping the finance sector by offering smarter, personalized services with real-time interactions and eliminating wait times. They automate tasks, cut costs, and reduce errors, while efficiently handling multiple queries.

Here are some useful applications of Banking AI Chatbots:

- Check account balance.

- Answer basic questions.

- Lead generation.

- Fraud detection.

Are you looking to deploy AI-driven conversational experiences on a secure infrastructure? Let’s get started with empowering your fintech journey with Cloudelligent. Book a meeting now!

3. AI-Powered Regulatory Compliance Solutions

Generative AI plays a pivotal role in automating compliance processes. It also ensures financial institutions adhere to various regulatory requirements. It can sift through vast regulatory text, interpret changes, and help companies adapt their operations accordingly.

Below are some use cases of Generative AI in Regulatory Compliance:

- Ensures compliance with regulations such as (AML) anti-money laundering and (KYC) know-your-customer.

- Automates compliance form processes.

- Reduces human errors in compliance management.

- Facilitates timely filing of compliance forms.

Latest Fintech News and Emerging Industry Trends

There is fierce competition among top fintech startups, companies, and banks to leverage customer data and other resources to enhance customer experiences. Teams are diligently working on fintech applications. Just as the iPhone revolutionized app development, there’s now a race to develop the most innovative application for Generative AI in Fintech.

The advent of user-friendly financial tools powered by cloud service providers such as AWS, are poised to improve accessibility and efficiency. Moreover, Generative AI shows promise in optimizing organizations’ regulatory compliance efforts by effectively analyzing and presenting data. However, it’s crucial for institutions to be aware of and mitigate emerging risks associated with these advancements.

Accelerate Your Fintech Journey With Gen AI and Cloudelligent

Enhance your business’s financial scalability, optimize performance, and upgrade security with Cloudelligent’s advanced solutions. They are designed to propel your organization forward through the power of Generative AI.

With AWS at your fingertips, you can streamline operations, drive innovation, and stay ahead of the competition in the dynamic landscape of the fintech industry! Connect with our team of AI experts today!